Increase portfolio value based on data, not just gut.

Coworking won't work everywhere. Our data shines a light on which buildings it will, so you can focus time and money to rapidly increase the value of your assets. Our feasibility studies and data are based on operating coworking for 14 years.

Your Portfolio is Under Attack

Traditional office leasing is dying. Smart funds are already moving.

Office vacancy rates are hitting 20-40% nationwide. Corporate mandates for in-office work are failing. Remote and hybrid work isn't going away. Traditional lease structures are broken.

While you're debating the future of work, sophisticated investors are deploying capital into data-driven flexible workspace plays. They're buying "underperforming" office buildings at traditional metrics and converting them to cash-flowing coworking assets.

The question isn't whether the office market will recover. It's whether you'll adapt before your competitors do.

The Numbers Don't Lie

A New Perspective on Coworking Success

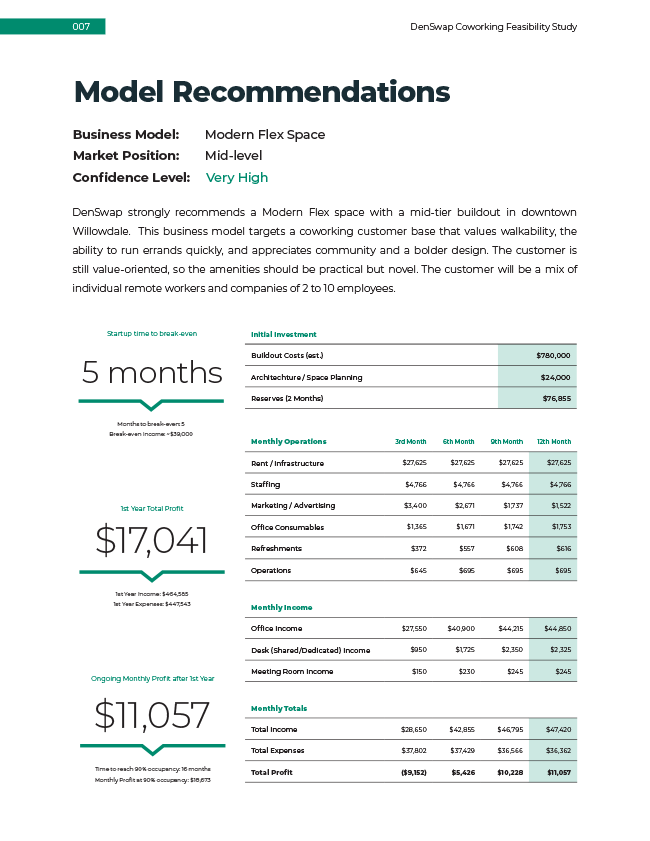

We use a data-driven approach, backed by 14 years of experience, to identify profitable coworking opportunities that traditional CRE firms miss.

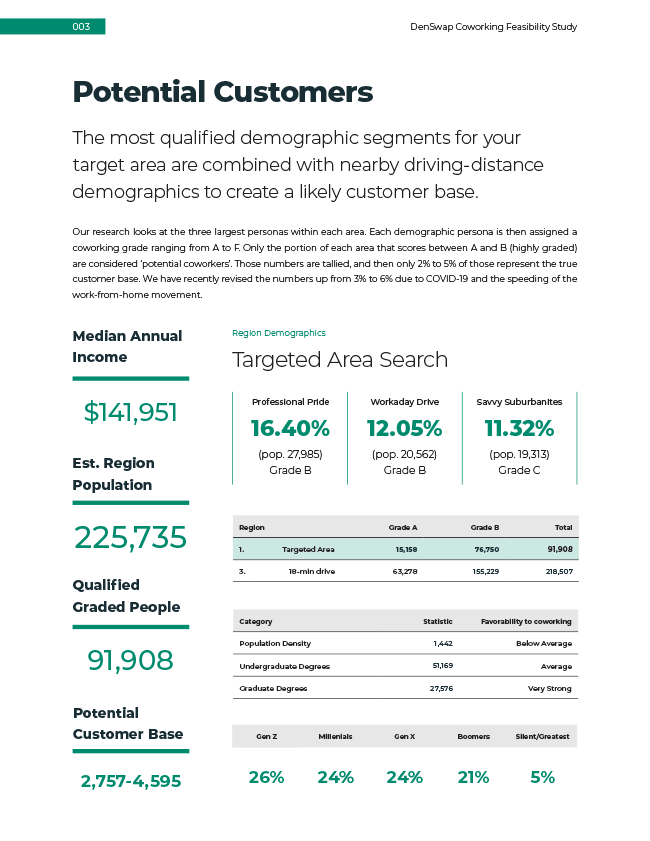

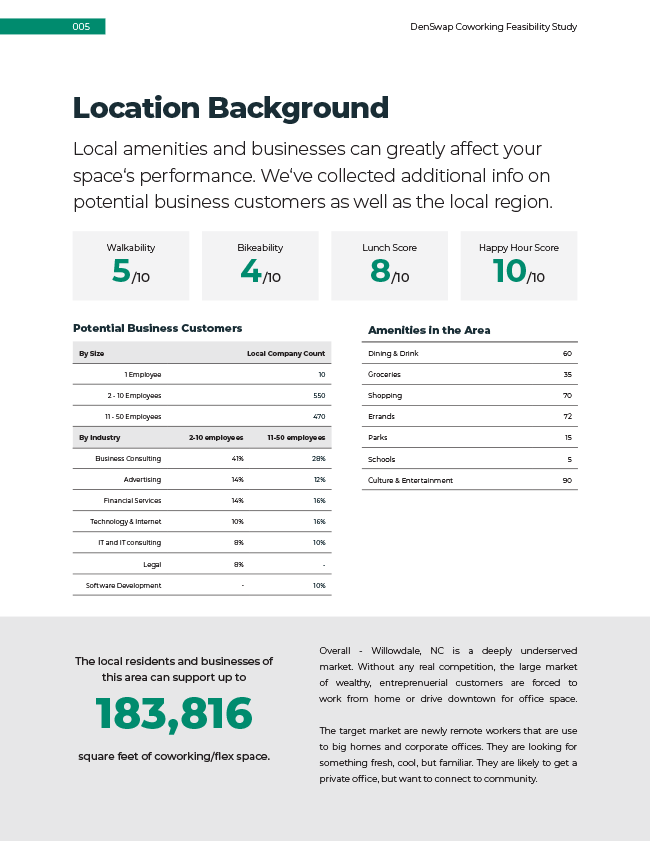

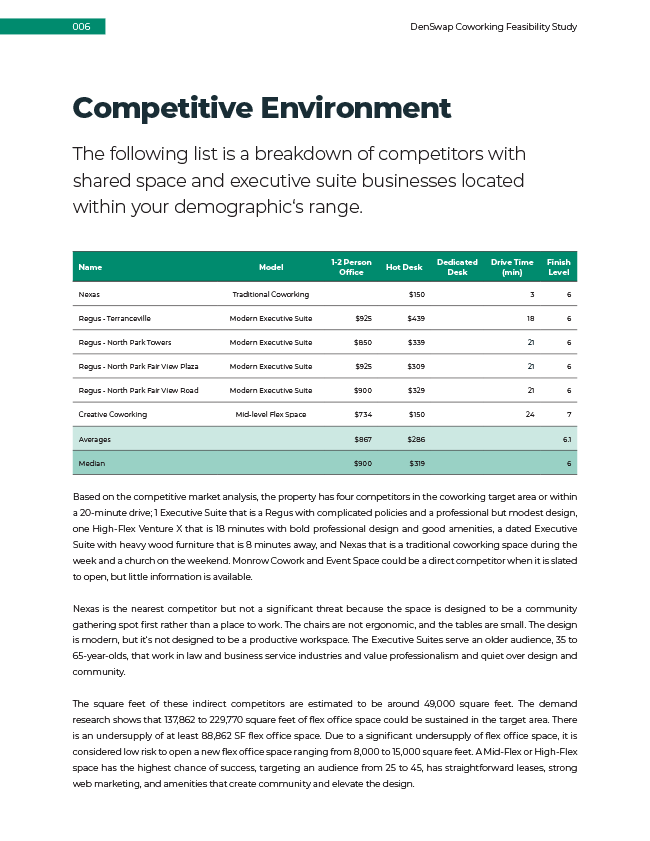

Our methodology goes beyond outdated metrics like census data and traffic counts. We analyze the specific factors that drive coworking demand, such as the local freelance economy, remote work trends, and the presence of specific industries.

This allows us to identify markets with strong pricing power, avoid oversaturation, and pinpoint the buildings with the highest potential for success. We don't just find locations; we find opportunities.

We look past surface-level data to uncover the real drivers of coworking demand.

We identify the specific building types and locations that are primed for coworking success.

Our analysis helps you avoid oversaturated markets and locations with low pricing power.

Our data is backed by over a decade of hands-on experience in the coworking industry.

Turn Struggling Assets into Premium Properties

Our data transforms underperforming office buildings into high-yield coworking investments

Driving Premium Rent Prices

Coworking commands 2-3x higher revenue per square foot than traditional office leasing. Our data identifies markets where you can achieve premium pricing without oversaturation.

Attracting High-End Tenants

Premium coworking attracts professionals, consultants, and growing companies who pay consistently and value quality workspace. No more chasing corporate tenants who might not renew.

Decreasing Tenant Attrition

Coworking members have higher retention rates than traditional office tenants because they're invested in the community and workspace experience, not just square footage.

Identifying Undervalued Properties

Our market intelligence reveals buildings being sold at traditional CRE discounts that have massive coworking upside potential. Get first-mover advantage on hidden opportunities.

Portfolio Optimization Solutions

Data-driven tools designed for institutional investors and fund managers

Single Location

Get a detailed analysis of a single property to determine its potential as a coworking space.

Portfolio Review

Let us analyze your entire portfolio to identify the best opportunities for coworking conversions and maximize your returns.

Real Results from Real Portfolios

Case study: How a regional investment fund increased portfolio NOI by 45%

Regional Investment Fund

From struggling assets to premium portfolio

The Challenge

A regional investment fund was hemorrhaging cash on four office buildings with average vacancy rates of 55%. Traditional re-leasing efforts had failed for 18 months.

Our Solution

We analyzed all four properties and recommended converting two to coworking while optimizing the other two for traditional tenants based on micro-market dynamics.

"DenSwap's analysis saved us from making a $5M mistake and showed us where to deploy capital for maximum returns."

The Risk of Doing Nothing

While you debate, your competitors are already moving capital

Every month you wait is capital deployment opportunity lost. The funds moving first on coworking conversions are seeing 2-3x returns while traditional office investors watch their assets bleed value.

Your board wants answers. Your LPs want returns. Your competitors are getting both by embracing the fundamental shift in how office space generates revenue.

This isn't about following trends. It's about following the money.

What Elite Funds Are Doing:

The Math Is Simple

Your Portfolio's Future Starts Today

Don't let another quarter pass watching your assets underperform. Get the intelligence that transforms struggling properties into portfolio stars.

Ready to Transform Your Property?

Get in touch with our team to discuss your coworking potential and receive a custom analysis.

Let's Discuss Your Vision

Our experts are ready to analyze your property and provide data-driven recommendations for coworking success. Every conversation starts with understanding your goals and constraints.

What to Expect:

- Initial consultation within 24 hours

- Custom analysis proposal

- Detailed feasibility study delivery