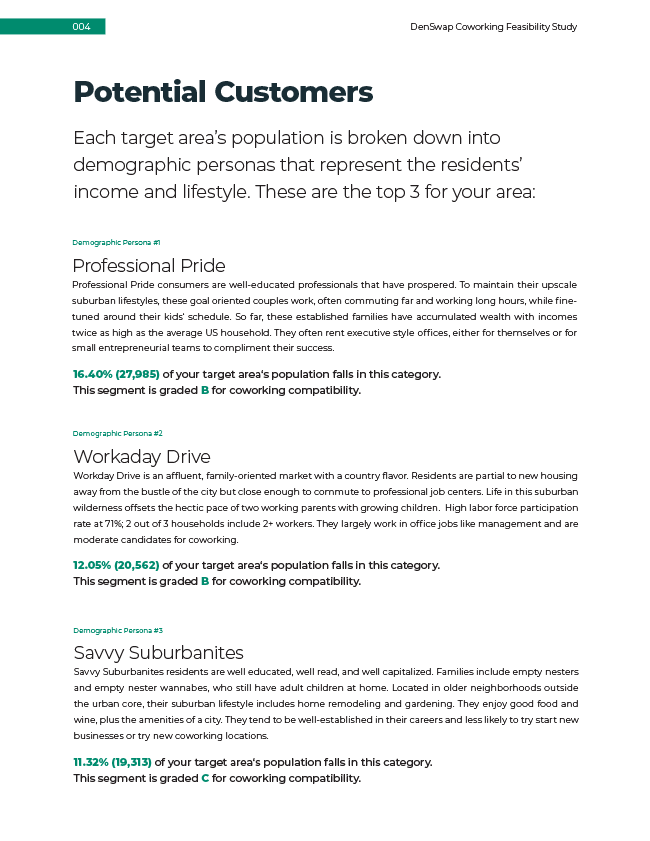

What Type & Expected P&L?

Detailed financial modeling with revenue projections, optimal space allocation, build-out costs, and quarterly P&L forecasts tailored to your specific market.

Comprehensive Financial Analysis

We model every aspect of your coworking business to give you accurate, actionable financial projections.

Revenue Projections

Membership tiers, pricing strategy, and revenue ramp-up modeling

Space Allocation

Optimal mix of open desks, private offices, and common areas

Build-out Costs

Construction, furniture, technology, and setup cost estimates

Operating Expenses

Staffing, utilities, marketing, and ongoing operational costs

Sample Financial Model

15,000 SF coworking space in a mid-tier market

Revenue Model

Space Allocation

Membership Tiers

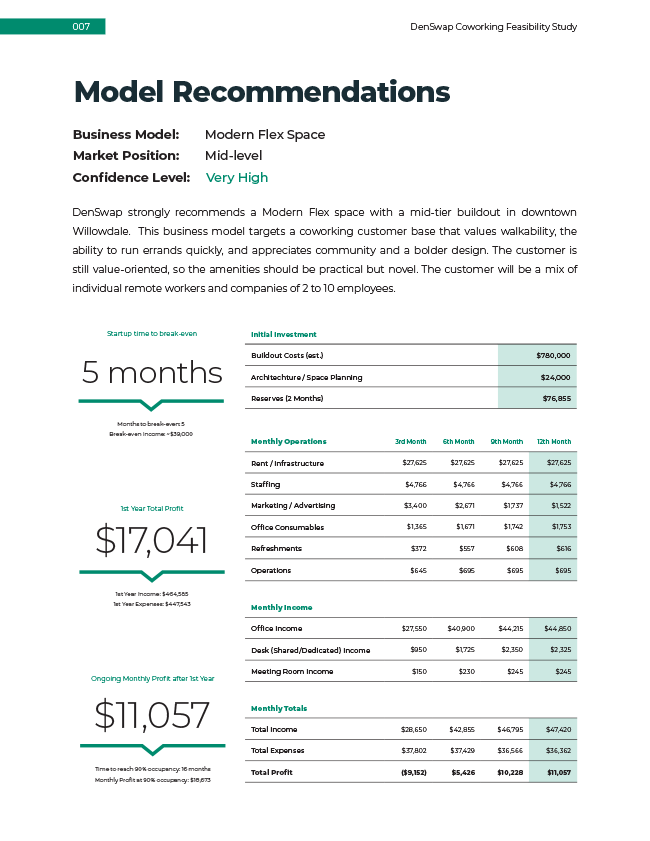

Initial Investment

Monthly Operating Expenses

Key Metrics

Quarterly Growth Projections

Realistic ramp-up timeline based on market conditions and our experience

| Quarter | Occupancy | Revenue | Expenses | Net Income | Cumulative |

|---|---|---|---|---|---|

| Q1 | 25% | $15,515 | $43,550 | -$28,035 | -$84,105 |

| Q2 | 45% | $27,927 | $43,550 | -$15,623 | -$130,974 |

| Q3 | 65% | $40,339 | $43,550 | -$3,211 | -$140,607 |

| Q4 | 75% | $46,545 | $43,550 | $2,995 | -$131,622 |

| Q5 | 85% | $52,751 | $43,550 | $9,201 | -$104,019 |

| Q6 | 85% | $52,751 | $43,550 | $9,201 | -$67,215 |

Complete Financial Package

Revenue Optimization

Membership pricing strategy, space utilization optimization, and ancillary revenue opportunities.

- Optimal membership mix analysis

- Dynamic pricing recommendations

- Additional revenue streams

Cost Management

Detailed breakdown of all startup and operating costs with optimization recommendations for maximum profitability.

- Build-out cost optimization

- Operational efficiency analysis

- Vendor and supplier recommendations

Risk Analysis

Scenario planning with best case, worst case, and most likely outcomes to help you make informed decisions.

- Sensitivity analysis

- Market downturn scenarios

- Mitigation strategies

Get Your Custom Financial Model

Receive detailed financial projections tailored to your specific property and market conditions - backed by real-world coworking experience.